Chapter 52 of Roughing It:

Since I desire, in this chapter, to say an instructive word or two about the silver mines, the reader may take this fair warning and skip, if he chooses. The year 1863 was perhaps the very top blossom and culmination of the “flush times.” Virginia swarmed with men and vehicles to that degree that the place looked like a very hive—that is when one’s vision could pierce through the thick fog of alkali dust that was generally blowing in summer. I will say, concerning this dust, that if you drove ten miles through it, you and your horses would be coated with it a sixteenth of an inch thick and present an outside appearance that was a uniform pale yellow color, and your buggy would have three inches of dust in it, thrown there by the wheels. The delicate scales used by the assayers were inclosed in glass cases intended to be air-tight, and yet some of this dust was so impalpable and so invisibly fine that it would get in, somehow, and impair the accuracy of those scales.

Since I desire, in this chapter, to say an instructive word or two about the silver mines, the reader may take this fair warning and skip, if he chooses. The year 1863 was perhaps the very top blossom and culmination of the “flush times.” Virginia swarmed with men and vehicles to that degree that the place looked like a very hive—that is when one’s vision could pierce through the thick fog of alkali dust that was generally blowing in summer. I will say, concerning this dust, that if you drove ten miles through it, you and your horses would be coated with it a sixteenth of an inch thick and present an outside appearance that was a uniform pale yellow color, and your buggy would have three inches of dust in it, thrown there by the wheels. The delicate scales used by the assayers were inclosed in glass cases intended to be air-tight, and yet some of this dust was so impalpable and so invisibly fine that it would get in, somehow, and impair the accuracy of those scales.

Speculation ran riot, and yet there was a world of substantial business going on, too. All freights were brought over the mountains from California (150 miles) by pack-train partly, and partly in huge wagons drawn by such long mule teams that each team amounted to a procession, and it did seem, sometimes, that the grand combined procession of animals stretched unbroken from Virginia to California. Its long route was traceable clear across the deserts of the Territory by the writhing serpent of dust it lifted up. By these wagons, freights over that hundred and fifty miles were $200 a ton for small lots (same price for all express matter brought by stage), and $100 a ton for full loads. One Virginia firm received one hundred tons of freight a month, and paid $10,000 a month freightage. In the winter the freights were much higher. All the bullion was shipped in bars by stage to San Francisco (a bar was usually about twice the size of a pig of lead and contained from $1,500 to $3,000 according to the amount of gold mixed with the silver), and the freight on it (when the shipment was large) was one and a quarter per cent. of its intrinsic value.

So, the freight on these bars probably averaged something more than $25 each. Small shippers paid two per cent. There were three stages a day, each way, and I have seen the out-going stages carry away a third of a ton of bullion each, and more than once I saw them divide a two-ton lot and take it off. However, these were extraordinary events. [Mr. Valentine, Wells Fargo’s agent, has handled all the bullion shipped through the Virginia office for many a month. To his memory—which is excellent—we are indebted for the following exhibit of the company’s business in the Virginia office since the first of January, 1862: From January 1st to April 1st, about $270,000 worth of bullion passed through that office, during the next quarter, $570,000; next quarter, $800,000; next quarter, $956,000; next quarter, $1,275,000; and for the quarter ending on the 30th of last June, about $1,600,000. Thus in a year and a half, the Virginia office only shipped $5,330,000 in bullion. During the year 1862 they shipped $2,615,000, so we perceive the average shipments have more than doubled in the last six months. This gives us room to promise for the Virginia office $500,000 a month for the year 1863 (though perhaps, judging by the steady increase in the business, we are under estimating, somewhat). This gives us $6,000,000 for the year. Gold Hill and Silver City together can beat us—we will give them $10,000,000. To Dayton, Empire City, Ophir and Carson City, we will allow an aggregate of $8,000,000, which is not over the mark, perhaps, and may possibly be a little under it. To Esmeralda we give $4,000,000. To Reese River and Humboldt $2,000,000, which is liberal now, but may not be before the year is out. So we prognosticate that the yield of bullion this year will be about $30,000,000. Placing the number of mills in the Territory at one hundred, this gives to each the labor of producing $300,000 in bullion during the twelve months. Allowing them to run three hundred days in the year (which none of them more than do), this makes their work average $1,000 a day. Say the mills average twenty tons of rock a day and this rock worth $50 as a general thing, and you have the actual work of our one hundred mills figured down “to a spot”—$1,000 a day each, and $30,000,000 a year in the aggregate.—Enterprise. [A considerable over estimate—M. T.]]

Two tons of silver bullion would be in the neighborhood of forty bars, and the freight on it over $1,000. Each coach always carried a deal of ordinary express matter beside, and also from fifteen to twenty passengers at from $25 to $30 a head. With six stages going all the time, Wells, Fargo and Co.‘s Virginia City business was important and lucrative.

All along under the centre of Virginia and Gold Hill, for a couple of miles, ran the great Comstock silver lode—a vein of ore from fifty to eighty feet thick between its solid walls of rock—a vein as wide as some of New York’s streets. I will remind the reader that in Pennsylvania a coal vein only eight feet wide is considered ample.

Virginia was a busy city of streets and houses above ground. Under it was another busy city, down in the bowels of the earth, where a great population of men thronged in and out among an intricate maze of tunnels and drifts, flitting hither and thither under a winking sparkle of lights, and over their heads towered a vast web of interlocking timbers that held the walls of the gutted Comstock apart. These timbers were as large as a man’s body, and the framework stretched upward so far that no eye could pierce to its top through the closing gloom. It was like peering up through the clean-picked ribs and bones of some colossal skeleton. Imagine such a framework two miles long, sixty feet wide, and higher than any church spire in America. Imagine this stately lattice- work stretching down Broadway, from the St. Nicholas to Wall street, and a Fourth of July procession, reduced to pigmies, parading on top of it and flaunting their flags, high above the pinnacle of Trinity steeple. One can imagine that, but he cannot well imagine what that forest of timbers cost, from the time they were felled in the pineries beyond Washoe Lake, hauled up and around Mount Davidson at atrocious rates of freightage, then squared, let down into the deep maw of the mine and built up there. Twenty ample fortunes would not timber one of the greatest of those silver mines. The Spanish proverb says it requires a gold mine to “run” a silver one, and it is true. A beggar with a silver mine is a pitiable pauper indeed if he cannot sell.

I spoke of the underground Virginia as a city. The Gould and Curry is only one single mine under there, among a great many others; yet the Gould and Curry’s streets of dismal drifts and tunnels were five miles in extent, altogether, and its population five hundred miners. Taken as a whole, the underground city had some thirty miles of streets and a population of five or six thousand. In this present day some of those populations are at work from twelve to sixteen hundred feet under Virginia and Gold Hill, and the signal-bells that tell them what the superintendent above ground desires them to do are struck by telegraph as we strike a fire alarm. Sometimes men fall down a shaft, there, a thousand feet deep. In such cases, the usual plan is to hold an inquest.

If you wish to visit one of those mines, you may walk through a tunnel about half a mile long if you prefer it, or you may take the quicker plan of shooting like a dart down a shaft, on a small platform. It is like tumbling down through an empty steeple, feet first. When you reach the bottom, you take a candle and tramp through drifts and tunnels where throngs of men are digging and blasting; you watch them send up tubs full of great lumps of stone—silver ore; you select choice specimens from the mass, as souvenirs; you admire the world of skeleton timbering; you reflect frequently that you are buried under a mountain, a thousand feet below daylight; being in the bottom of the mine you climb from “gallery” to “gallery,” up endless ladders that stand straight up and down; when your legs fail you at last, you lie down in a small box-car in a cramped “incline” like a half-up-ended sewer and are dragged up to daylight feeling as if you are crawling through a coffin that has no end to it. Arrived at the top, you find a busy crowd of men receiving the ascending cars and tubs and dumping the ore from an elevation into long rows of bins capable of holding half a dozen tons each; under the bins are rows of wagons loading from chutes and trap-doors in the bins, and down the long street is a procession of these wagons wending toward the silver mills with their rich freight. It is all “done,” now, and there you are. You need never go down again, for you have seen it all. If you have forgotten the process of reducing the ore in the mill and making the silver bars, you can go back and find it again in my Esmeralda chapters if so disposed.

Of course these mines cave in, in places, occasionally, and then it is worth one’s while to take the risk of descending into them and observing the crushing power exerted by the pressing weight of a settling mountain. I published such an experience in the Enterprise, once, and from it I will take an extract:

AN HOUR IN THE CAVED MINES.—We journeyed down into the Ophir mine, yesterday, to see the earthquake. We could not go down the deep incline, because it still has a propensity to cave in places. Therefore we traveled through the long tunnel which enters the hill above the Ophir office, and then by means of a series of long ladders, climbed away down from the first to the fourth gallery. Traversing a drift, we came to the Spanish line, passed five sets of timbers still uninjured, and found the earthquake. Here was as complete a chaos as ever was seen—vast masses of earth and splintered and broken timbers piled confusedly together, with scarcely an aperture left large enough for a cat to creep through. Rubbish was still falling at intervals from above, and one timber which had braced others earlier in the day, was now crushed down out of its former position, showing that the caving and settling of the tremendous mass was still going on. We were in that portion of the Ophir known as the “north mines.” Returning to the surface, we entered a tunnel leading into the Central, for the purpose of getting into the main Ophir. Descending a long incline in this tunnel, we traversed a drift or so, and then went down a deep shaft from whence we proceeded into the fifth gallery of the Ophir. From a side-drift we crawled through a small hole and got into the midst of the earthquake again—earth and broken timbers mingled together without regard to grace or symmetry. A large portion of the second, third and fourth galleries had caved in and gone to destruction—the two latter at seven o’clock on the previous evening.

At the turn-table, near the northern extremity of the fifth gallery, two big piles of rubbish had forced their way through from the fifth gallery, and from the looks of the timbers, more was about to come. These beams are solid—eighteen inches square; first, a great beam is laid on the floor, then upright ones, five feet high, stand on it, supporting another horizontal beam, and so on, square above square, like the framework of a window. The superincumbent weight was sufficient to mash the ends of those great upright beams fairly into the solid wood of the horizontal ones three inches, compressing and bending the upright beam till it curved like a bow. Before the Spanish caved in, some of their twelve-inch horizontal timbers were compressed in this way until they were only five inches thick! Imagine the power it must take to squeeze a solid log together in that way. Here, also, was a range of timbers, for a distance of twenty feet, tilted six inches out of the perpendicular by the weight resting upon them from the caved galleries above. You could hear things cracking and giving way, and it was not pleasant to know that the world overhead was slowly and silently sinking down upon you. The men down in the mine do not mind it, however.

Returning along the fifth gallery, we struck the safe part of the Ophir incline, and went down it to the sixth; but we found ten inches of water there, and had to come back. In repairing the damage done to the incline, the pump had to be stopped for two hours, and in the meantime the water gained about a foot. However, the pump was at work again, and the flood-water was decreasing. We climbed up to the fifth gallery again and sought a deep shaft, whereby we might descend to another part of the sixth, out of reach of the water, but suffered disappointment, as the men had gone to dinner, and there was no one to man the windlass. So, having seen the earthquake, we climbed out at the Union incline and tunnel, and adjourned, all dripping with candle grease and perspiration, to lunch at the Ophir office.

During the great flush year of 1863, Nevada [claims to have] produced $25,000,000 in bullion—almost, if not quite, a round million to each thousand inhabitants, which is very well, considering that she was without agriculture and manufactures. Silver mining was her sole productive industry.

[Since the above was in type, I learn from an official source that the above figure is too high, and that the yield for 1863 did not exceed $20,000,000.] However, the day for large figures is approaching; the Sutro Tunnel is to plow through the Comstock lode from end to end, at a depth of two thousand feet, and then mining will be easy and comparatively inexpensive; and the momentous matters of drainage, and hoisting and hauling of ore will cease to be burdensome. This vast work will absorb many years, and millions of dollars, in its completion; but it will early yield money, for that desirable epoch will begin as soon as it strikes the first end of the vein. The tunnel will be some eight miles long, and will develop astonishing riches. Cars will carry the ore through the tunnel and dump it in the mills and thus do away with the present costly system of double handling and transportation by mule teams. The water from the tunnel will furnish the motive power for the mills. Mr. Sutro, the originator of this prodigious enterprise, is one of the few men in the world who is gifted with the pluck and perseverance necessary to follow up and hound such an undertaking to its completion. He has converted several obstinate Congresses to a deserved friendliness toward his important work, and has gone up and down and to and fro in Europe until he has enlisted a great moneyed interest in it there.

Schornhurst writes on how money was actually made in the mines of Virginia City. The Life of Mark Twain: The Early Years, 1835-1871, pp 180-1

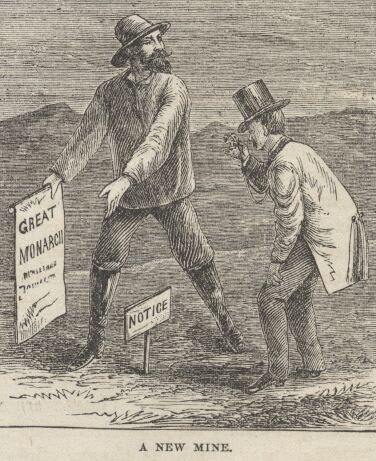

Sam elsewhere bragged about a related job benefit: he was often given shares in mines if he would “get up an excitement” for them in his column. “Reporting was lucrative, and every man in the town was lavish with his money and his “feet,” he noted in Roughing It. This quid pro quo was, of course, a conflict of interest if not a bribe, but it was not illegal. He bragged to his family in July 1863 that he had “raised the price of ‘North Ophir’ from $13 a foot to $45 a foot” by his puffs and as a reward “they gave me five feet” in the mine. During the summer of 1863, he repeatedly touted the prospects of Hale & Norcross, of which he had been given several shares. “From the increasing richness of the developments being made in the Hale & Norcross mine,” he publicly reported in July, “I think you may count on a great advance in the price of that stock within the next few days.’ A week later, he descended three hundred feet into the main shaft of the Hale & Norcross mine and “found they had not yet struck the ledge in the lower level, and will not for the next five or six days’”—plenty of time to allow for some insider trading. Or, another month later, “The Hale & Norcross continues to supply a number of mills with choice rock; the stock has advanced to $2,600 in this market.” The footage he was given in return for these plugs and others like them was still subject to periodic assessments; that is, like the other stockholders he was levied a fee to keep the mine open if it failed to earn a profit and pay dividends. In a sense, then, the shares were more invoices than gifts. In May 1863 Sam received ten shares in the Fresno Mining Company, and in August he was listed as the owner of five shares in the Sonora Silver Mining Company with a nominal value of five thousand dollars. In December, he was assessed fifty dollars on twenty-five shares of the Nightingale Mining Company that he no doubt had been given for favors in kind. This method of developing claims, not by reinvesting profits or dividends but by taxing stockholders, was of course liable to fraud. The directors of the Bullion Mine famously lived on the $3.8 million in assessments they levied on the stockholders, while the mine never produced any paying ore. In 1867, of the four hundred mining companies in Virginia City, only three—the Ophir, the Gould & Curry, and the Savage—paid dividends, while most of the others simply collected assessments. Over the years, in fact, according to Elisha P. Douglass, as many as five thousand claims “were located and traded within thirty miles of Virginia City. Only 300 were ever opened, only 20 became mines, and of these only 8 or 9 paid dividends.” Or as Sam observed in Roughing It, there were “more mines than miners” in Washoe and “not ten of these mines were yielding rock worth hauling to a mill’—his inclination to plug every new excavation in the Enterprise notwithstanding. But the opportunity to puff a stock still proved lucrative. In April 1863 he wrote his family that he had recently been given fifty feet in the East India Gold and Silver Mining Company for which he had been offered nearly five thousand dollars.